The Basic Principles Of Health Insurance

Wiki Article

All about Medicaid

Table of ContentsHow Insurance can Save You Time, Stress, and Money.Facts About Life Insurance UncoveredFascination About Home InsuranceExamine This Report on Travel Insurance

You Might Want Disability Insurance Too "Contrary to what numerous people think, their home or automobile is not their biggest property. Instead, it is their capacity to earn an income. Lots of specialists do not guarantee the chance of a special needs," stated John Barnes, CFP and also proprietor of My Family members Life Insurance Policy, in an e-mail to The Equilibrium./types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)

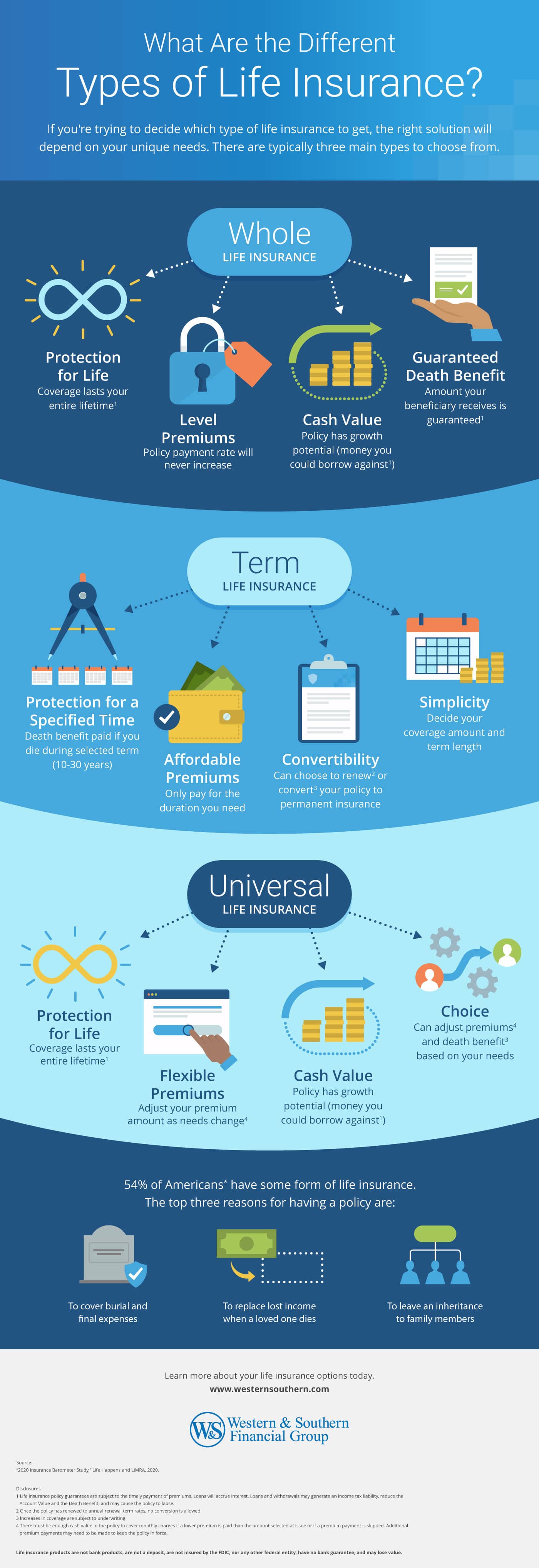

The information listed below concentrates on life insurance policy offered to people. Term Term Insurance coverage is the simplest form of life insurance policy. It pays just if fatality occurs throughout the term of the policy, which is typically from one to 30 years. The majority of term policies have nothing else benefit stipulations. There are two standard kinds of term life insurance coverage plans: degree term and decreasing term.

The cost per $1,000 of advantage increases as the insured individual ages, and it undoubtedly gets very high when the insured lives to 80 and also beyond. The insurer might bill a premium that enhances each year, yet that would make it very hard for most individuals to manage life insurance coverage at innovative ages.

The Ultimate Guide To Home Insurance

Insurance plan are made on the principle that although we can not stop unfavorable occasions occurring, we can protect ourselves monetarily against them. There are a vast variety of different insurance plans offered on the market, and all insurance firms try to persuade us of the merits of their particular product. Much so that it can be hard to choose which insurance policy policies are truly essential, as well as which ones we can reasonably live without.Scientists have discovered that if the key breadwinner were to die their family members would only be able to cover their house expenses for just a couple of months; one in 4 families would have troubles covering their outgoings promptly. Most insurance firms recommend that you take out cover for around ten times your annual earnings - renters insurance.

You ought to likewise consider child care expenses, as well as future college costs if suitable. There are 2 primary sorts insurance companies of life insurance plan to select from: entire life plans, and term life plans. You spend for entire life policies till you pass away, and also you spend for term life plans for a collection time period identified when you secure the plan.

Medical Insurance, Medical Insurance is another one of the four main sorts of insurance that professionals suggest. A recent study revealed that sixty two percent of personal insolvencies in the United States in 2007 were as a direct result of illness. A surprising seventy 8 percent of these filers had medical insurance when their disease started.

Cheap Car Insurance Fundamentals Explained

Premiums vary substantially according to your age, your present state of wellness, and also your lifestyle. Also if it is not a legal demand to take out vehicle insurance policy where you live it is highly recommended that you have some type of policy in location as you will certainly still have to think financial obligation in the situation of an accident.In enhancement, your automobile is frequently among your most valuable possessions, and also if it is damaged in a crash you might battle to spend for repair work, or for a replacement. You could also find yourself liable for injuries sustained by your guests, or the driver of an additional lorry, and also for damage caused to another vehicle as a result of your oversight.

General insurance coverage covers residence, your travel, vehicle, as well as health (non-life assets) Website from fire, floods, accidents, man-made disasters, and also theft. Various sorts of general insurance coverage consist of electric motor insurance coverage, medical insurance, traveling insurance, and also residence insurance coverage. A general insurance coverage policy pays for the losses that are sustained by the guaranteed during the duration of the policy.

Read on to recognize even more regarding them: As the home is a valuable property, it is necessary to protect your home with a proper. Residence as well as family insurance policy safeguard your residence and the products in find out this here it. A residence insurance coverage basically covers manufactured and also all-natural scenarios that may result in damage or loss.

The Buzz on Renters Insurance

It is available in two kinds, third-party as well as extensive. When your car is accountable for an accident, third-party insurance coverage deals with the harm triggered to a third-party. You have to take into account one truth that it does not cover any of your automobile's damages. It is also crucial to keep in mind that third-party motor insurance is compulsory according to the Motor Vehicles Act, 1988.

When it comes to health insurance coverage, one can choose for a standalone health policy or a family members drifter plan that uses protection for all family members. Life insurance policy gives insurance coverage for your life.

Life insurance is different from general insurance on different criteria: is a temporary agreement whereas life insurance is a long-term contract. In the situation of life insurance, the advantages and also the sum ensured is paid on the maturity of the plan or in the event of the plan holder's death.

The general insurance cover that is compulsory is third-party obligation vehicle insurance. Each and also every type of general insurance policy cover comes with a purpose, to use protection for a specific aspect.

Report this wiki page